In the Alcohol Act, farmers are defined as people running an agricultural operation with at least one hectare of eligible land under cultivation, or 50 ares in the case of those growing special crops, or 30 ares in the case of those with vines in steep and terraced areas.

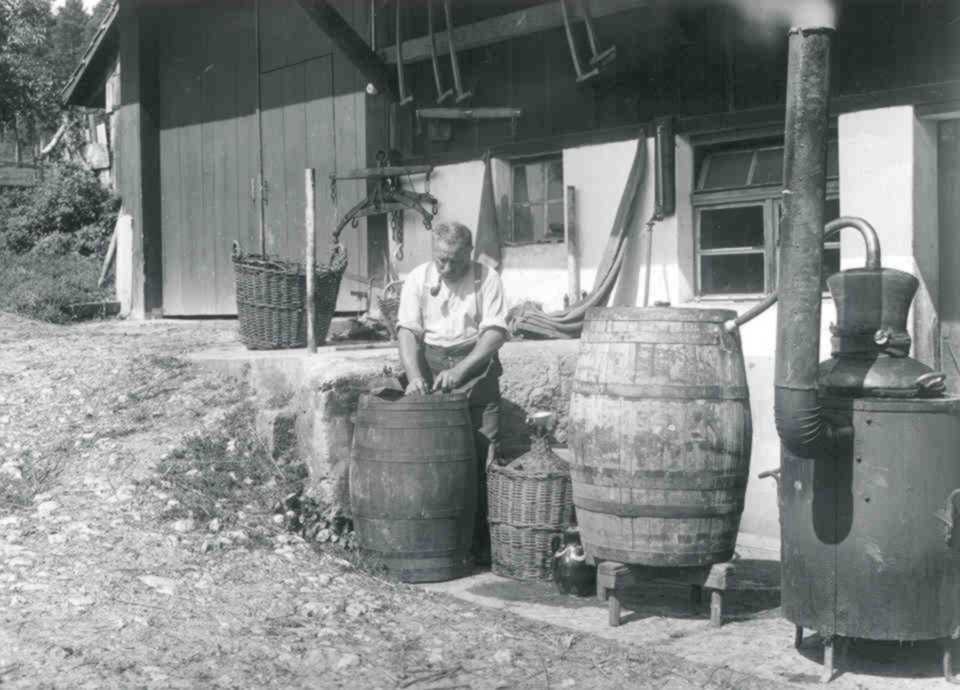

Farmers are allowed to process only raw materials which they have grown themselves on their own agricultural land or which they have foraged themselves in Switzerland. The raw materials must be processed in their own home distillery or in contract distilleries.

Agricultural distiller's licences

An agricultural distiller's licence can be issued only in connection with existing distillery equipment. Moreover, the licence is tied to the agricultural operation (distillery building). If the farm changes ownership, the distiller's licence passes to the new owner of the farm. The new owner must meet the FOCBS 's requirements for classification as a farmer.

Tax (Art. 22 ff. of the AlcO)

As a general rule, spirits required in agricultural operations are not subject to tax. The maximum permissible amount is calculated annually according to various criteria based on farm data from the Federal Office for Agriculture (FOAG). For spirits that are used for purposes other than in the household or on the farm, the corresponding tax must be paid. Farmers must submit an annual online declaration detailing the spirits transferred and the final stock. You can find the instructions here (PDF, 2 MB, 03.11.2025).

If you do not wish to fill out an annual declaration, you can voluntarily give up your classification as farmer and apply to be reclassified as a small producer. Small producers receive an annual tax rebate.

The tax assessment is done largely according to the self-declaration principle. If annual production exceeds 200 litres of pure alcohol, agricultural operations become subject to commercial controls and have to keep spirits accounts.

This page contains useful information and forms for farmers.

Contact

Federal Office for Customs and Border Security FOCBS

Alcohol Sector

Route de la Mandchourie 25

2800 Delémont

- Tel.

- +41 58 462 65 00

- Fax

- +41 58 463 18 28