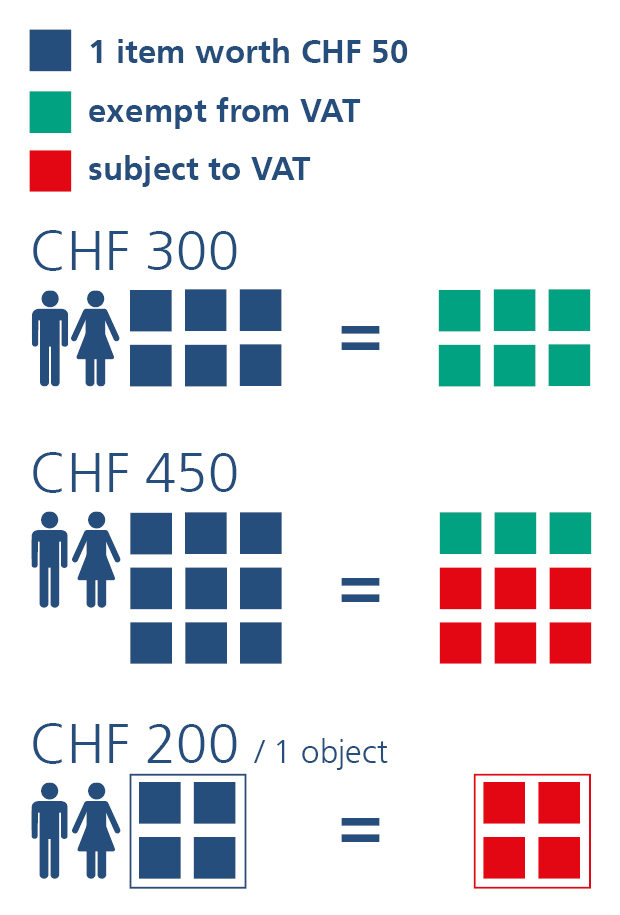

Examples of how the tax-free limit is applied in the case of several people jointly submitting a customs declaration

One person submits a customs declaration for two people who are importing the following goods (each case must be regarded independently)

1. An item costing CHF 200 (e.g. furniture, dress, watch, car service, domestic pet)

⇒ Single items worth more than CHF 150 are always subject to VAT. Value added tax must be paid on the item.

2. Two items costing CHF 120 each

⇒ The tax-free limit for two people can be claimed, i.e. the items can be imported tax-free.

3. Three items at CHF 120 each

⇒ The tax-free limit can be claimed by one person (CHF 150); the tax-free limit for the second person is exceeded. VAT must be paid on CHF 210 (360 - 150 = 210).

4. Bags of grocery shopping that do not exceed the applicable maximum allowances, worth a total of CHF 500.

⇒ The tax-free limit can be claimed by one person for CHF 150; the tax-free limit for the second person is exceeded. VAT has to be paid for groceries worth CHF 350 (500 - 150 = 350).

One person submits a customs declaration for three people who are importing the following goods (each case must be regarded independently)

1. An item costing CHF 400 (e.g. furniture, dress, watch, car service, domestic pet)

⇒ Single items worth more than CHF 150 are always subject to VAT. Value added tax must be paid on the item.

2. Five items costing CHF 120 each

⇒ The tax-free limit can be claimed by two people (CHF 150 each); the tax-free limit for the third person is exceeded. VAT must be paid on CHF 300 (600 - 300 = 300).

3. Two items costing CHF 120 each and an item costing CHF 200

⇒ The tax-free limit can be claimed by two people for the two items costing CHF 120 each. Given that VAT always has to be paid for an item costing more than CHF 150, VAT is due on CHF 200.

4. Five items costing CHF 120 each and an item costing CHF 200

⇒ The tax-free limit can be claimed by two people (CHF 150 each); the tax-free limit for the third person is exceeded. VAT must be paid on CHF 500 (600 - 300 = 300 + 200 = 500)

Further information

Further info

Customs info: essential information at a glance (PDF, 982 kB, 19.12.2024)With this brochure, we wish to help make your passage through Swiss Customs a smooth one. Are you familiar with our QuickZoll app?